ESG Investing

As part of the DNA of Amundi Equities, our wide ESG offering is articulated around four pillars in order to meet your clients’ needs.

Very Strict Approach to ESG

Global Ecology Strategy

- This strategy has a 30-years track-record and has a long manager tenure (the portfolio manager has remained unchanged since 2003).

- It represents a unique opportunity to gain exposure to growing and sustainable secular trends that are aligned to the 17 UNs Sustainable Development Goals.

- This strategy offers a real ESG exposure, through a truly diversified and comprehensive set of ESG objectives.

- The strict ESG focus has not compromised performance, in fact our portfolio’s long-term track record outperforms both the MSCI World Index and its Morningstar peer group.

Identifying tomorrow’s winners – a unique dynamic approach to ESG

ESG Improvers franchise

- While most would look at ESG integration from a statistic perspective, we launched a process that integrates ESG criteria in a dynamic manner.

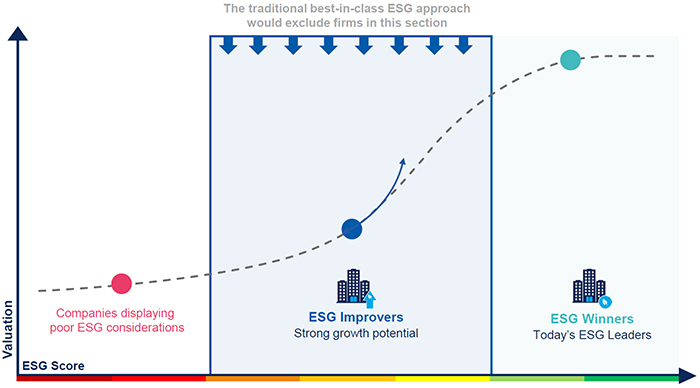

- ESG winners are quality companies with attractive valuations and strong ESG ratings, while ESG improvers are corporates portraying a solid fundamental investment case and an improving ESG trend, but not yet an ESG leader. A combination of the two, in our view, will allow investors to benefit from the improvement in ESG ratings before a trend materialises and the premium is established. Hence, it will be important to include both ESG winners and ESG improvers in portfolios.

ESG combined with Income

Equity Sustainable Income Franchise

We see ESG as a source of alpha opportunity. On the positive side, we believe that sustainable business models (the strong ESG stewards) are well positioned to benefit from the structural shift towards ESG friendly investments. ESG conscious companies tend to enjoy less volatility in their profitability and companies with more stable profits have the potential to deliver a more stable and sustainable dividend.

Engagement

Japan

- The structural changes that Japanese corporates have gone through the last several years are a tailwind for the engagement investors like us. Japanese corporates have room to improve on ESG practices, which offers ample room to unlock the value through engagement on ESG angles.

- This is a high conviction based strategy with a focus on qualitythat offers a unique investment solution. We believe that this represents an attractive solution for investors seeking alpha while making a positive ESG impact on Japanese corporates, through their investment.

- We seek companies, which we believe have established mechanisms necessary to deliver growth on a sustainable basis. We try to integrate ESG in a dynamic manner leveraging both global and local ESG specialist resources. We engage directly with companies to help encourage long-term value creation. Our engagement topics are very variable from business strategy to ESG issues as we cover the value creation process.

- Our long investment horizon allows us to take full advantage of building credibility with the companies and seeking to influence the management on the corporate strategy.

France

- The engagement philosophy applied to the France Engagement strategy is to encourage major French companies to improve their ESG practices by leveraging off its position as a shareholder.

- Our approach is based on shareholder dialogue and has a long-term investment horizon. The objective of the strategy is two-fold. First, we aim at improving the analysis of the risks and opportunities facing French companies. In addition, we try to support them in the continuous improvement of their ESG practices through company meetings and to accompany them toward both energy transition and social cohesion strengthening, which are two key themes of the Amundi’s 2021 engagement policy.

- The investment process is based on a combination of both financial and ESG analysis, leveraging off the expertise and experience of Amundi's equity research and ESG analysts.

Learn more

Equities Offering

Amundi Equities uniquely combines a strong local presence, active company engagement, deep equity research capabilities and an integrated portfolio construction with a disciplined and repeatable high conviction investment process.

Innovation

Innovation is part of our DNA. Amundi Equities launched three new active ESG strategies – an area in which a structural shift in client allocations continues.

This information is exclusively intended for “Professional” investors within the meaning of the MiFID Directive 2004/39/EC of 21 April 2004, and articles 314-4 and following of the General Regulations of the AMF. It is not intended for the general public or for non-professional individual investors within the meaning of all local regulations, or for “US Persons”, as defined in the Securities and Exchange Commission’s “Regulation S” under the 1933 U.S. Securities Act.

This non-contractual information does not under any circumstances constitute an offer to buy, a solicitation to sell, or advice to invest in financial instruments of Amundi or one of its affiliates (“Amundi”).

Investing involves risks. The performance of the strategies is not guaranteed. In addition, past performance is not in any way a guarantee or a reliable indicator of current or future performance. Investors may lose all or part of the capital originally invested.

Potential investors are encouraged to consult a professional adviser in order to determine whether such an investment is suitable for their profile and must not base their investment decisions solely on the information contained in this document.

Amundi assumes no liability, either direct or indirect, resulting from the use of any of the information contained in this document, and shall not under any circumstances be held liable for any decisions taken on the basis of this information. This information may not be copied, reproduced, modified, translated or distributed, without the prior written approval of Amundi, for any third person or entity in any country or jurisdiction which would subject Amundi or any of its products to any registration requirements within these jurisdictions or where this might be considered unlawful.

This information is provided to you based on sources that Amundi considers to be reliable, and it may be modified without prior warning.