Engagement for all investors

Amundi pools the best of the Group’s capabilities to advise and work alongside asset owners in their “responsible” approach.

Engagement: accompanying issuers to better practices

Reflecting the continuous dialogue between Amundi and companies, our engagement for influence aims to support companies in taking into account environmental, social and governance (ESG) issues on specific themes.

Since 2019 and in particular in 2020, Amundi has been focusing its voting and engagement efforts on two priority themes: the energy transition and social cohesion. Both topics represent systemic risks for companies as well as opportunities for those who wish to integrate them in a positive way.

Amundi’s engagement process relies on a multi-faced approach:

- ongoing engagement on specific challenges or sustainability risks faced by an issuer or a sector,

- thematic engagement comprising of to cross-sectorial engagement on key topics such as climate or the living wage,

- collaborative engagement favoring collective efforts to encourage issuers to act collectively on key sustainable issues.

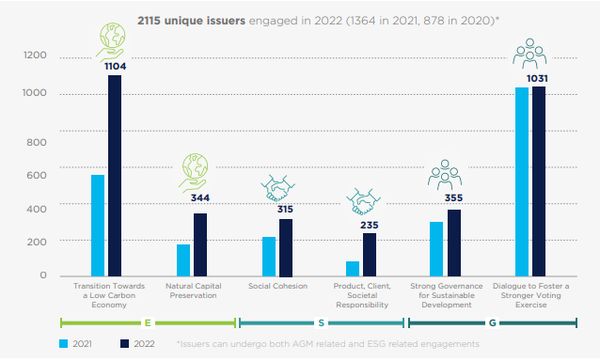

In 2022, Amundi engaged with issuers on 6 main areas, 2115 issues were raised.

Environment

- Transition towards a low carbon economy

- Natural capital preservation

Social

- Social cohesion through the protection of direct and indirect employees and Promotion of human rights

- Client, Product and Social Responsibility

Governance

- Governance practices for Sustainable Development

- Dialogues to foster a stronger voting exercice and a stronger corporate governance

Engagement broken down by topic1

1 Source: Stewardship Report 2022

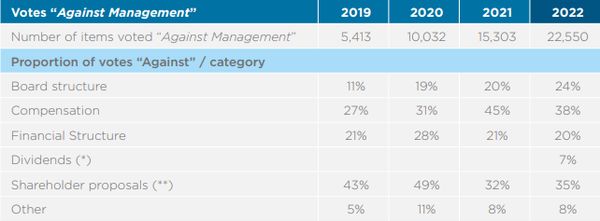

(*) A new “Dividends” category was created in 2022. These proposals were previously recorded in the “Other” category.

(**) Does not include votes for which there was no management recommendation Source: Amundi Asset Management

In 2022 Amundi participated to 10,208 General Meeting and voted on 107,297 Resolutions.

69%General meetings at which we voted against at least one resolution |

21%Votes against resolutions |

Thematic breakdown of votes "against management"2

2 Source : Rapport d’Engagement 2022

Amundi’s leadership has been recognized by ShareAction’s “ Voting matters 2023 ” report, according to which Amundi ranks among the top 3 asset managers in terms of voting performance on environmental and social issues (up from 10th last year).

In the same section

Responsible investment offering

A wide range of responsible solutions from open-ended funds to tailor-made Responsible Investment.

Environment initiatives

Bring the fight against climate change accessible to all investors.

Social Initiatives

Social impact innovative solutions reaching financial performance objectives.

Responsible Investing: our commitment

Acting as a responsible financial institution is a core commitment of Amundi’s development strategy.

This information is exclusively intended for “Professional” investors within the meaning of the MiFID Directive 2004/39/EC of 21 April 2004, and articles 314-4 and following of the General Regulations of the AMF. It is not intended for the general public or for non-professional individual investors within the meaning of all local regulations, or for “US Persons”, as defined in the Securities and Exchange Commission’s “Regulation S” under the 1933 U.S. Securities Act.

This non-contractual information does not under any circumstances constitute an offer to buy, a solicitation to sell, or advice to invest in financial instruments of Amundi or one of its affiliates (“Amundi”).

Investing involves risks. The performance of the strategies is not guaranteed. In addition, past performance is not in any way a guarantee or a reliable indicator of current or future performance. Investors may lose all or part of the capital originally invested.

Potential investors are encouraged to consult a professional adviser in order to determine whether such an investment is suitable for their profile and must not base their investment decisions solely on the information contained in this document.

There is no guarantee that ESG considerations will enhance a fund’s investment strategy or performance.

Amundi assumes no liability, either direct or indirect, resulting from the use of any of the information contained in this document, and shall not under any circumstances be held liable for any decisions taken on the basis of this information. This information may not be copied, reproduced, modified, translated or distributed, without the prior written approval of Amundi, for any third person or entity in any country or jurisdiction which would subject Amundi or any of its products to any registration requirements within these jurisdictions or where this might be considered unlawful.

This information is provided to you based on sources that Amundi considers to be reliable, and it may be modified without prior warning.