Solvency II: your tailor-made solution

Solvency II is due to come in to force on 1st January 2016. The new regulatory requirements, coupled with the current market context will have a huge impact on insurance companies. Based in Europe, Amundi is well versed in the implications of these regulatory changes and has built a dedicated platform to support insurers through the transition.

Amundi: providing insurers with robust expertise and multi-dimensional solution

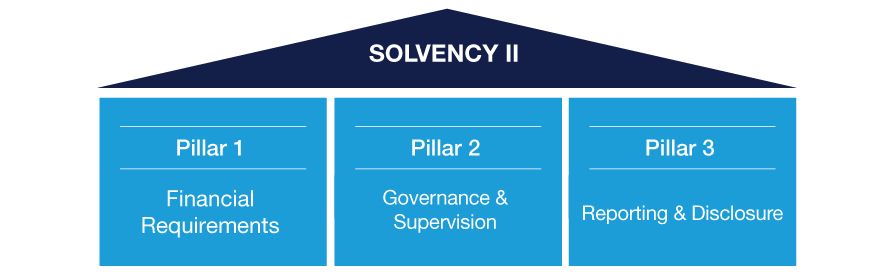

Solvency II is a pivotal issue for insurers and asset managers alike. At Amundi, our teams are set up to address the three key areas, or pillars, of Solvency II. Our goal: to provide insurers with dedicated services, from look-through reporting to investment solutions under insurance constraints.

Reporting

- Look-through for funds and mandates: up to the third level if necessary for the funds managed by Amundi. Regarding the funds managed by third-party asset managers, look-through is subject to the collection of the required data and authorisation

- Enriched market data: enriched line-by-line inventory in Ampère/TPT1 with or without CQS2, according to the client’s choice. This inventory can also include global Gross Market SCR3 as calculated by Amundi

Investment solutions under insurance constraints

- Portfolios and asset allocation analysis and monitoring, in accordance with Solvency II requirements

-

Construction of solutions that decrease regulatory capital usage within the strategies

1. TPT : Tri Partite Template.

2. CQS : Credit Quality Steps.

3. Solvency Capital Requirement

In order to gain access to CQS and ratings data, we recommend our clients sign appropriate licenses with the rating agencies of their choice among which Amundi has signed: Standard & Poor’s, Moddy’s and Fitch.

The low-interest environment has led insurers to seek out higher yielding investments as a steady source of income, sometimes turning to infrastructure financing projects.In this context, the European Commission plans to lower the capital charge in infrastructure investments. This draft amendment, released in late September, introduces new rules for calculating the capital charge for qualifying long-term investments for insurance companies.

The three pillars of Solvency II

For illustration only. May change without notice.

Expert talk

Philippe Ithurbide

Global Head of Research"Our solvency tools largely benefit from our top class quantitative research and close regulatory watch."

Our analysis of Solvency II

Discover our latest research papers on Solvency II.

1- European Insurance and Occupational Pensions Authority

2- Solvency Capital Requirement

This information is exclusively intended for “Professional” investors within the meaning of the MiFID Directive 2004/39/EC of 21 April 2004, and articles 314-4 and following of the General Regulations of the AMF. It is not intended for the general public or for non-professional individual investors within the meaning of all local regulations, or for “US Persons”, as defined in the Securities and Exchange Commission’s “Regulation S” under the 1933 U.S. Securities Act.

This non-contractual information does not under any circumstances constitute an offer to buy, a solicitation to sell, or advice to invest in financial instruments of Amundi or one of its affiliates (“Amundi”).

Investing involves risks. The performance of the strategies is not guaranteed. In addition, past performance is not in any way a guarantee or a reliable indicator of current or future performance. Investors may lose all or part of the capital originally invested.

Potential investors are encouraged to consult a professional adviser in order to determine whether such an investment is suitable for their profile and must not base their investment decisions solely on the information contained in this document.

There is no guarantee that ESG considerations will enhance a fund’s investment strategy or performance.

Amundi assumes no liability, either direct or indirect, resulting from the use of any of the information contained in this document, and shall not under any circumstances be held liable for any decisions taken on the basis of this information. This information may not be copied, reproduced, modified, translated or distributed, without the prior written approval of Amundi, for any third person or entity in any country or jurisdiction which would subject Amundi or any of its products to any registration requirements within these jurisdictions or where this might be considered unlawful.

This information is provided to you based on sources that Amundi considers to be reliable, and it may be modified without prior warning.