Bespoke investment solutions for the UK insurance market

With knowledge gained from over 25 years of serving insurance clients in the UK and elsewhere, Amundi has the expertise to develop investment solutions tailored to your specific accounting, financial and regulatory requirements.

New accounting standard

More complex implementation and more volatile results. Find out how the application of IFRS 9 starting in 2018 will complicate the processing of some financial instruments and may increase the volatility of profit and loss.

Amundi innovates

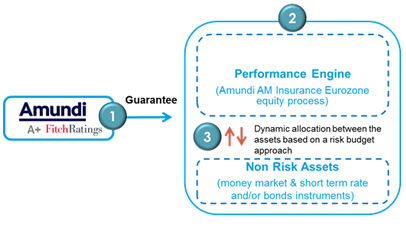

A Constant Proportion Portfolio Insurance combining Eurozone equity strategy and SCR optimization, with a formal protection.

Given the complex environment they are facing –strengthened regulatory environment, decreasing interest rate environment, increasing consideration given to economic risk, Insurers are looking for new opportunities. Innovative ones that may answer a call: how will they face their day to day prerogatives to their clients (attractive return) while complying with both their financial and regulatory issues. Indeed, they need to search for yield but at lower costs.

Regarding the appealing return and risk premium of Eurozone equities, Amundi has designed a new solution, genuine in the market, which combines cautious equity investment process - seeking risk/return optimization - and bank guarantee of 80% of capital protection on a yearly rolling basis.

This in-house solution offers:

- Dividends and equity return benefits

- Dynamic risk management strategy mitigating markets drawdown effects and SCR equity

- Amundi’s formal guarantee to the protection (Amundi is A+ rated by Fitch Ratings2)

By combining financial market and regulatory efficiency, Amundi AM’s equity solution is an effective way to optimize insurers’ equity allocation and capital charge:

- Increase the expected return of the asset allocation with the same level of Market SCR

- Reduce the Market SCR with the same expected return

Our solution does not offer any performance or full capital guarantee.

Helping, you balance risk, return and capital requirements

The low yield environment, lower liquidity levels and an ever more challenging regulatory environment have heightened the need for diversification and innovation. Insurers and asset managers alike will need to think outside the box in order to meet their targets in the face of such headwinds.

With nearly 40% of our total assets managed for insurance clients, we understand the specific needs of this industry in the midst of significant change. Our extensive resources and capabilities span the globe allowing us to provide you with a seamless end-to-end service comprising advice, investment management as well as bespoke research and reports.

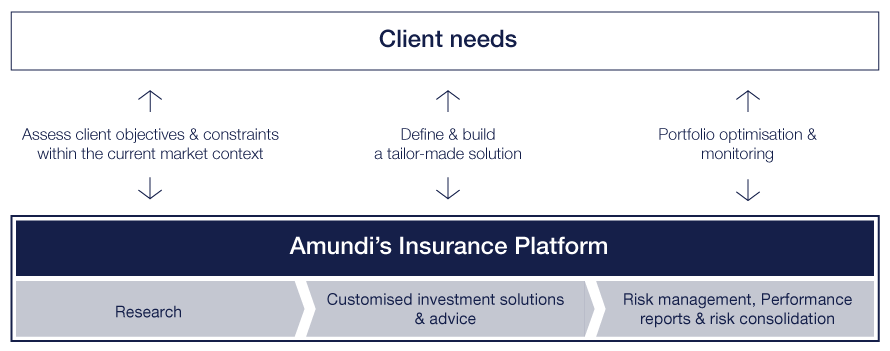

An integrated investment platform

Our integrated platform comprises more than 30 employees dedicated to the insurance business line and leverages on the resources of the wider group. From strategic, economic and financial research to our client servicing and risk management teams, our specialists are committed to providing you with innovative solutions to achieve your financial goals whilst also meeting regulatory requirements.

At the heart of this platform are our investment managers who are equipped with broad insurance knowledge and experience managing assets for Lloyd’s and related insurance clients. These experts are backed by a global asset manager with experience investing in a range of asset classes in order to offer both core US dollar expertise and portfolio diversification.

- Core fixed income investment expertise with satellite management for diversification through equities, alternative investments, absolute return, real estate and credit.

- Dedicated teams offering ALM/LDI.

- Provision of PRA/FCA, EIOPA as standard as well as bespoke look-through reports and consolidated financial statements.

- An in-house tool to calculate solvency capital requirements.

An integrated and centralised investment platform

Information given for illustrative purposes only, may be changed without prior notice.

Amundi at your service

Contact Us

Are you looking for more information?

Please feel free to contact our client service team, they will respond as soon as possible.

Our expertise at your service

01 | Our research department at your service

Analysing new sectors, reviewing regulatory changes, assessing risk management: our in-house research teams provide constant analysis and feedback about issues of interest and importance to the insurance industry. You can also commission specific research on request.

Take a look at our latest publications on Solvency II at our dedicated research website: research.amundi.com

02 | Customised investment solutions

Our investment solutions, including ALM/LDI, are designed around the accounting and liability constraints of insurance companies. They aim to meet risk-adjusted return objectives and are built using a core satellite approach within a strong risk-monitoring framework.

ALM: Asset and Liability Management

LDI: Liability Driven Investment

03 | Tailored risk management and reporting tools

Based in the heart of Europe, we are particularly well-versed in the requirements and implications of Solvency II. With independent risk management & client servicing functions providing risk monitoring, performance measurement and consolidated reports, we are able to provide tailor-made services to help our insurance clients comply with regulatory requirements.

Insurance, part of our DNA

25+

years in experience in UK insurance market

30%

of our total assets are managed for insurance companies1

130+

research analysts, renowned globally1

Our response to the challenges of Solvency II

Discover Solvency II issues and associated Amundi's services

1 - Source: Amundi, as of June 30, 2020.

2. Source: Amundi & Fitch Ratings, as of June 2016.

This information is exclusively intended for “Professional” investors within the meaning of the MiFID Directive 2004/39/EC of 21 April 2004, and articles 314-4 and following of the General Regulations of the AMF. It is not intended for the general public or for non-professional individual investors within the meaning of all local regulations, or for “US Persons”, as defined in the Securities and Exchange Commission’s “Regulation S” under the 1933 U.S. Securities Act.

This non-contractual information does not under any circumstances constitute an offer to buy, a solicitation to sell, or advice to invest in financial instruments of Amundi or one of its affiliates (“Amundi”).

Investing involves risks. The performance of the strategies is not guaranteed. In addition, past performance is not in any way a guarantee or a reliable indicator of current or future performance. Investors may lose all or part of the capital originally invested.

Potential investors are encouraged to consult a professional adviser in order to determine whether such an investment is suitable for their profile and must not base their investment decisions solely on the information contained in this document.

There is no guarantee that ESG considerations will enhance a fund’s investment strategy or performance.

Amundi assumes no liability, either direct or indirect, resulting from the use of any of the information contained in this document, and shall not under any circumstances be held liable for any decisions taken on the basis of this information. This information may not be copied, reproduced, modified, translated or distributed, without the prior written approval of Amundi, for any third person or entity in any country or jurisdiction which would subject Amundi or any of its products to any registration requirements within these jurisdictions or where this might be considered unlawful.

This information is provided to you based on sources that Amundi considers to be reliable, and it may be modified without prior warning.