Global investment Outlook 2024: Steering through turning tides

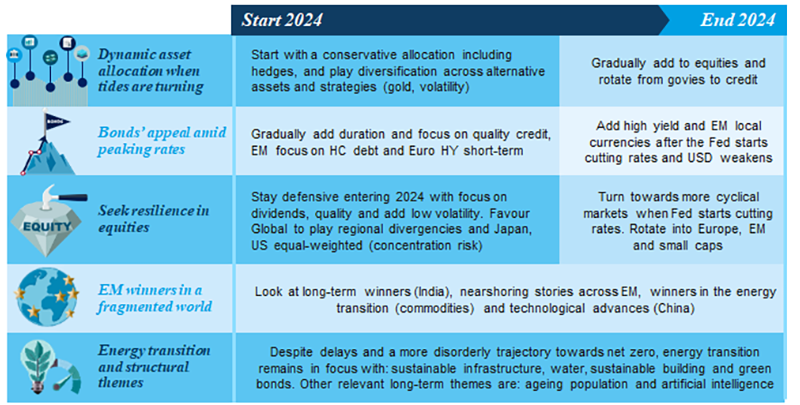

Turning tides in growth, inflation and monetary policy will generate opportunities for investors to rotate from a more defensive to a more constructive stance during the year.

For 2024, we see a fragmented outlook with divergent economic trajectories and geopolitical themes. A key feature will be the turning tide for monetary policy, taking a more accommodative stance at the end of the first half.

![]()

5 themes to keep an eye on

1. Turning tides in global growth, with US recession in sight for H1 2024

Assuming that the Middle East crisis remains contained, we expect a weaker global economic outlook, mainly driven by the slowdown in Developed Markets (DM). The US will tiptoe into a recession in H1, while Eurozone growth remains mildly positive.

2. Emerging Markets (EM) resilient but with higher fragmentation. Asia winner in investment flows

A great reallocation, friend/near-shoring, supply chain de-risking, as well as the net zero or technological transition/transformation should continue to direct investments towards Asia. India's economic prospects remain bright.

3. Inflation continues to moderate, but Central Banks remain vigilant

Weaker demand should help inflation converge towards Central Banks' targets by the end of next year, barring a major energy shock. DM Central Banks remain on a hawkish pause for H1, until inflation appears further under control, while EM Central Banks have some room to cut rates.

4. Financing the green transition is the main target for fiscal policies

Investments targeting the energy transition continue to be deployed in a constrained fiscal space, with governments trying to regain discipline. In the Eurozone, we see an acceleration in the release of NextGenerationEU (NGEU) funds. In the US, more investment will stem from incentives (IRA and CHIPS acts), but not enough to offset the consumption slowdown.

5. Geopolitical realignment at play in 2024

As new challenges to the global order emerge, most countries will continue to prioritise individual needs and improve their positioning. We expect 2024 to be a year of transition, higher tension and growing protectionism.

What could the global economy look like in 2024?

A fragmented outlook, with low tide on growth

Investment Convictions from our CIOs

Investing in 2024 will be about being long duration, building income with credit, EM bonds and dividends, and seeking growth in Asia, as well as exploiting structural themes.

Diversification in 60/40 portfolios restored in a low growth/ falling inflation scenario, but watch out for volatility increase

The high disparity in valuations and the drying up of excess liquidity will lead to higher equity volatility. Lower growth/diminishing inflation may favour a return to negative bond-equity correlation, benefitting cross asset strategies.

Fixed income is king amid peaking rates

High debt levels and the normalisation of central bank balance sheets will mean that markets will have to absorb a higher supply of bonds. Yields, at their highest levels in multiple years, may attract long-term investors willing to reload the income engine of their portfolios. Adding duration on entering 2024 will be key, as well as favouring high-quality credit. Currency management will be key next year, with a weaker US dollar on the cards.

In equities, defensiveness and quality value first, then cyclical markets/sectors when the easing cycle starts

Concentration risk is high as US equity market upside has been driven by just a few names. Entering 2024, favour value in the US and Japan, and sustainable dividends globally. Later, move towards more cyclical markets and sectors, such as Europe.

EM bonds lifted by peaking rates and inflation. In equities, Asia in focus

A pause, followed by cuts from the Fed and a possible US dollar depreciation, bode well for EM assets. Fixed income hard currency debt is favoured at the start of the year and local currency debt should be in focus when the Fed pivot approaches.

ESG investing should focus on net zero and explore themes that are gaining traction

The energy transition remains the top focus. We expect investments into EM to accelerate with the private sector playing a key role. In equities, we are focusing on the decarbonisation of buildings, food waste reduction, sustainable farming and technologies that can boost the transition.

Explore Amundi's 2024 Global Investment Outlook

This information is exclusively intended for “Professional” investors within the meaning of the MiFID Directive 2004/39/EC of 21 April 2004, and articles 314-4 and following of the General Regulations of the AMF. It is not intended for the general public or for non-professional individual investors within the meaning of all local regulations, or for “US Persons”, as defined in the Securities and Exchange Commission’s “Regulation S” under the 1933 U.S. Securities Act.

This non-contractual information does not under any circumstances constitute an offer to buy, a solicitation to sell, or advice to invest in financial instruments of Amundi or one of its affiliates (“Amundi”).

Investing involves risks. The performance of the strategies is not guaranteed. In addition, past performance is not in any way a guarantee or a reliable indicator of current or future performance. Investors may lose all or part of the capital originally invested.

Potential investors are encouraged to consult a professional adviser in order to determine whether such an investment is suitable for their profile and must not base their investment decisions solely on the information contained in this document.

There is no guarantee that ESG considerations will enhance a fund’s investment strategy or performance.

Amundi assumes no liability, either direct or indirect, resulting from the use of any of the information contained in this document, and shall not under any circumstances be held liable for any decisions taken on the basis of this information. This information may not be copied, reproduced, modified, translated or distributed, without the prior written approval of Amundi, for any third person or entity in any country or jurisdiction which would subject Amundi or any of its products to any registration requirements within these jurisdictions or where this might be considered unlawful.

This information is provided to you based on sources that Amundi considers to be reliable, and it may be modified without prior warning.