India's Clean Energy Moment: Investment Opportunities

This Insight analyses India's Clean Energy Moment, detailing demand-side drivers, supply incentives (PLI, VGF), capital mobilisation and de‑risked investment...

As a trusted, responsible partner, our core role is to invest on our clients’ behalf, identifying opportunities that can deliver sustainable returns over time.

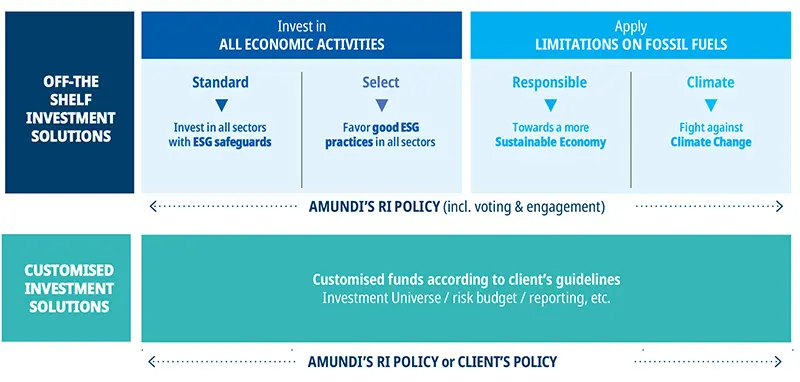

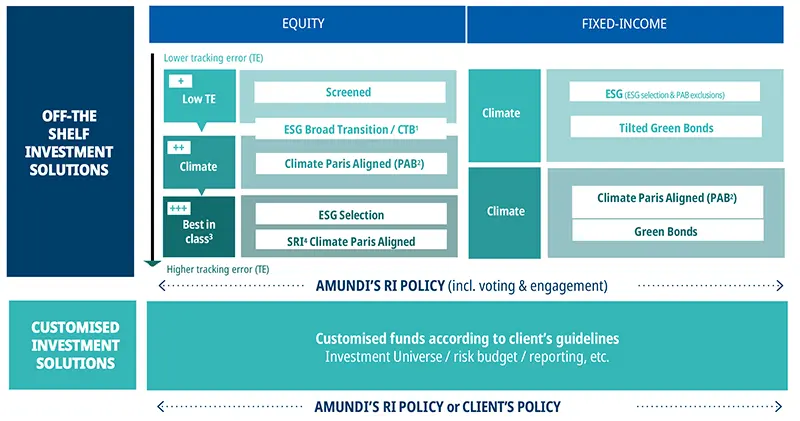

Drawing on our long standing experience as a responsible investor and our dedicated resources, we are committed to supporting investors willing to embrace sustainability with a comprehensive and all inclusive offering.

Investment Solutions

Invest in our RI

solutions

Services

Strengthen your RI management

Advisory

Design your customised RI strategy

Learn more about our comprehensive responsible investment capabilities by downloading our brochure

We believe there are multiple ways to integrate ESG criteria into investments.

Please refer to the Amundi Responsible Investment Policy and the Amundi Sustainable Finance Disclosure Statement available here.

Please refer to the Amundi Responsible Investment Policy and the Amundi Sustainable Finance Disclosure Statement available here.

1.Climate Transition Benchmark. 2. Paris Aligned Benchmark 3. Companies that are leaders in their sector in terms of meeting ESG criteria 4. Socially Responsible Investment.

Alongside our wide range of investment solutions, we provide an extensive suite of RI services enabling our clients to strengthen and meet their sustainability-related investment objectives.

Standard voting and engagement services with bespoke options available upon request.

ESG, climate, biodiversity, transition, regulatory (EU Taxonomy, French LEC 29), engagement and voting.

High-level conferences, dissemination of best practices, research, and thought-leadership content, etc.

A modular technology platform for real time portfolio analysis including climate and sustainability analytics.

We help you define your RI objectives, select preferred approaches, and identify measurement tools for your achievements, all aligned with your philosophy and evolving needs.

Highly customizable offering according to clients' needs |

Amundi (UK) Limited, authorised and regulated by the Financial Conduct Authority (the “FCA”) under number 114503. The FCA’s address is 12 Endeavour Square, London E20 1JN. In the United Kingdom, this information is approved by Amundi (UK) Limited for use solely by Professional Clients (as defined in the FCA’s Handbook of Rules and Guidance) and shall not be accessed by, or distributed to, the public. In the United Kingdom, this information is approved by Amundi (UK) Limited for use solely by Professional Clients (as defined in the FCA’s Handbook of Rules and Guidance) and shall not be accessed by, or distributed to, the public. It is also not intended for “US Persons”, as defined in the Securities and Exchange Commission’s “Regulation S” under the 1933 U.S. Securities Act. This non-contractual information does not under any circumstances constitute an offer to buy, a solicitation to sell, or advice to invest in financial instruments of Amundi (UK) Limited or one of its affiliates (“Amundi”). Investing involves risks. The performance of the strategies is not guaranteed. Past performance does not predict future results. Investors may lose all or part of the capital originally invested. There is no guarantee that ESG considerations will enhance a strategy’s performance. The decision of investors to invest in the promoted strategies should take into account all characteristics of objectives of the strategies. All investors should seek professional advice prior to any investment decision, in order to determine the risks associated with the investment and its suitability. Amundi assumes no liability, either direct or indirect, resulting from the use of any of the information contained in this document, and shall not under any circumstances be held liable for any decisions taken on the basis of this information. This information may not be copied, reproduced, modified, translated or distributed, without the prior written approval of Amundi. This information is provided to you based on sources that Amundi considers to be reliable at the date of publication, and it may be modified at any time without prior notice.